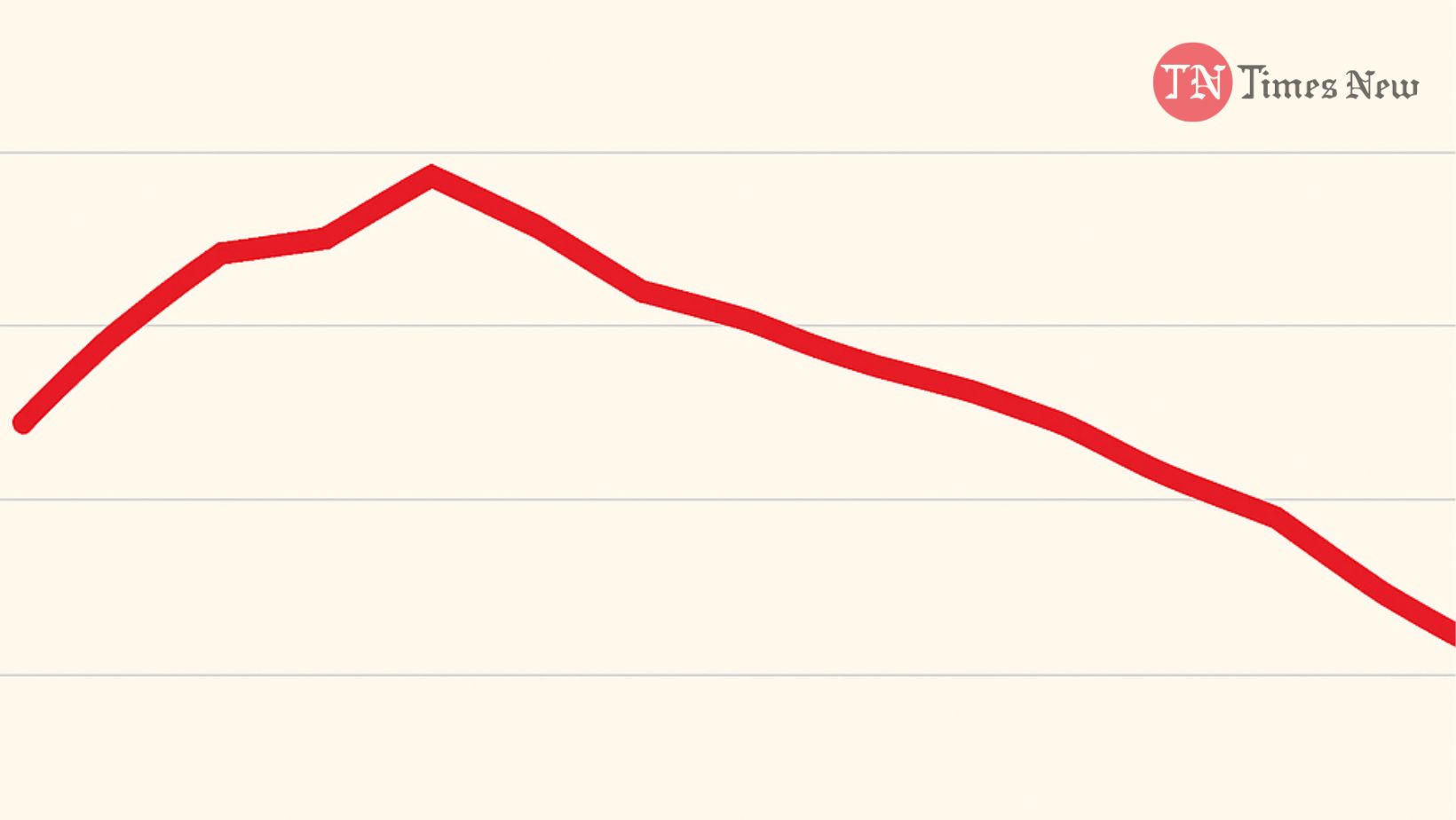

Canada’s annual inflation rate cooled to 2.2% in October, helped by lower gasoline prices, easing food costs, and a slowdown in mortgage interest charges, according to data released by Statistics Canada on Monday. Analysts had expected a slightly larger decline to 2.1%. Excluding the impact of the government’s removal of the carbon levy on gasoline, annual CPI still rose 2.7%, down from 2.9% in September.

A sharper monthly decline in gasoline prices drove much of the easing, with fuel costs falling 9.4% year over year in October compared to a 4.1% drop in September. Food inflation also decelerated, rising 3.4% annually after climbing 4.0% the previous month, although grocery prices have now outpaced overall inflation for nine straight months. Mortgage interest costs rose 2.9% annually — their first time below 3% in more than three years — while rent inflation accelerated above 5%.

Core inflation measures also showed signs of cooling. CPI-median eased to 2.9% from a revised 3.1% in September, while CPI-trim edged down to 3.0%. The inflation slowdown is expected to reinforce the Bank of Canada’s decision to pause rate cuts, keeping its policy rate at 2.25% next month. Following the data release, the Canadian dollar slipped slightly to 1.4030 against the U.S. dollar, and two-year government bond yields dipped 1.4 basis points to 2.437%.

Pic Courtesy: google/ images are subject to copyright